- February 27, 2026

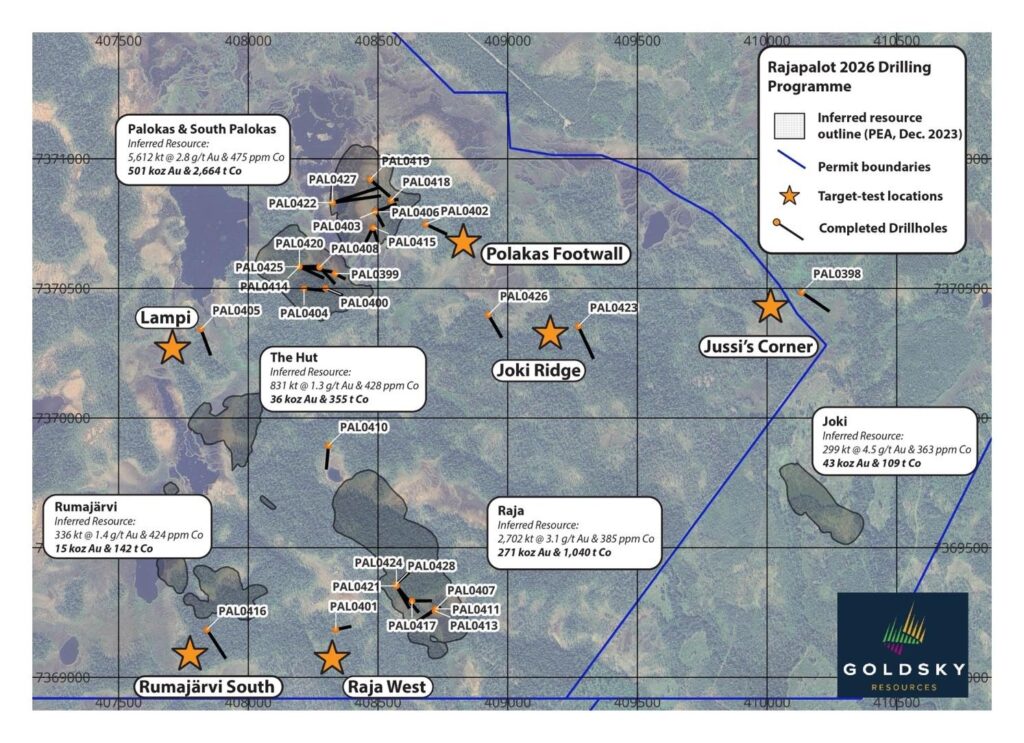

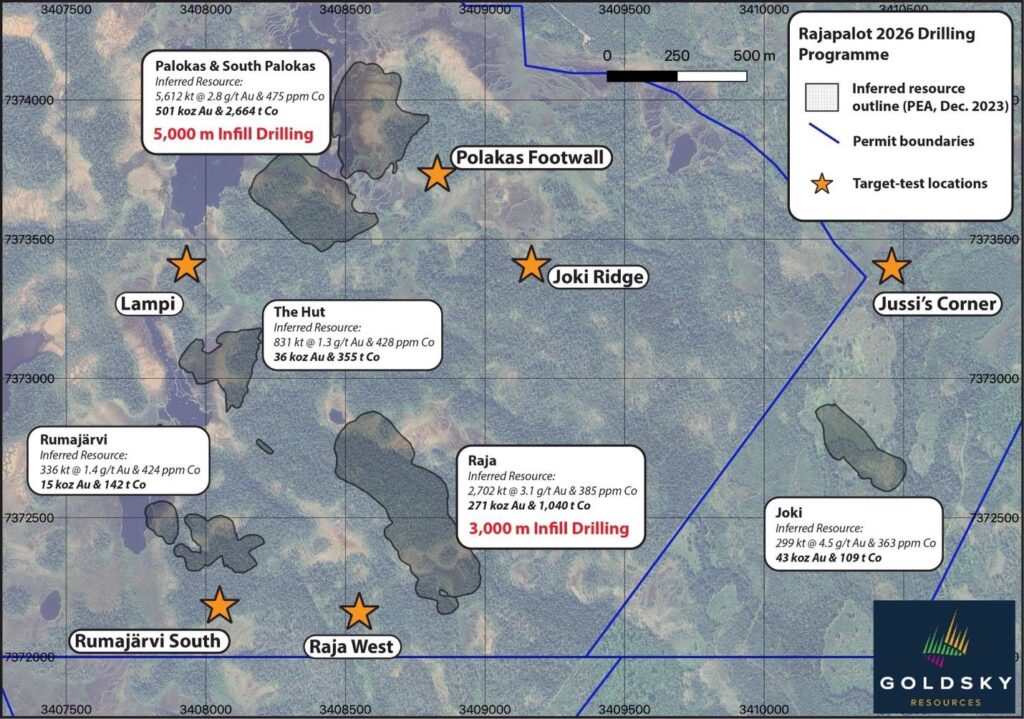

Goldsky Resources Provides Operational Update on 2026 Drilling Program at Rajapalot Gold-Cobalt Project, Finland

VANCOUVER, Canada, February 27, 2026— Goldsky Resources Corp (TSX-V: GSKR, FNSE: GSKR SDB, OTCQX: GSKRF, FRA: HEG0) (“Goldsky Resources” or the “Company”) is pleased to provide an operational update on its ongoing 2026 winter diamond drilling program at the Company’s 100%-owned Rajapalot Gold-Cobalt Project in Northern Finland.

HIGHLIGHTS

31 drill holes for 6,073 metres core drilled 61% of the planned 10,000 metre winter drilling program completed Four diamond drill rigs currently operating on site Drilling progressing at Palokas,- February 25, 2026

Goldsky Resources Appoints New Officers

VANCOUVER, Canada, February 25, 2026 — Goldsky Resources Corp. (TSXV: GSKR) (FNSE: GSKR SDB) (OTCQX: GSKRF) (FRA: HEG0) (“Goldsky Resources” or the “Company“) today announces that Brent Doster has been appointed as Chief Financial Officer (“CFO”) of the Company effective March 1, 2026 and that Karilyn Farmer has been appointed SVP, Exploration and Resource Development, effective April 21, 2026.

Mr.

- February 19, 2026

Goldsky Resources Closes Acquisition of Elemental Royalty’s Nordic Business Unit

VANCOUVER, Canada, February 19, 2026 — Goldsky Resources Corp (TSXV: GSKR) (FNSE: GSKR SDB) (OTCQX: GSKRF) (FRA: HEG0) (“Goldsky Resources” or the “Company“) is pleased to announce the closing of its previously announced acquisition of the Nordic business unit (“NBU Acquisition”) of Elemental Royalty Corporation (previously operating as EMX Royalty Corporation (“Elemental”)), a long-standing technical partner on several of Goldsky’s key assets.

The NBU Acquisition sees Goldsky acquiring Elemental’s regional infrastructure in northern Sweden (including an exploration camp),

- February 3, 2026

Goldsky Resources –2026 Drilling Program Commences at Rajapalot Gold Project, Finland

VANCOUVER, Canada, February 3, 2026 — Goldsky Resources Corp (TSX-V: GSKR, FNSE: GSKR SDB, OTCQX: GSKRF, FRA: HEG0) (“Goldsky Resources” or the “Company”) is pleased to announce the commencement of the 2026 winter drilling season at its 100% owned Rajapalot property in Northern Finland.

HIGHLIGHTS

Four diamond drill-rigs have been mobilized to site over the past weeks and have begun a 10,000 meter drilling program at Rajapalot Approximately 8,000 meters will focus on infill drilling at the Raja and Palokas deposits,- January 29, 2026

Goldsky Resources Issues Stock Options

VANCOUVER, Canada, January 29, 2026 — Goldsky Resources Corp (TSXV: GSKR) (FNSE: GSKR SDB) (OTCQX: GSKRF) (FRA: HEG0) (“Goldsky Resources” or the “Company“) today announced the grant of an aggregate of 6,690,000 stock options (the “Options”) to certain directors and officers of the Company pursuant to the Company’s stock option plan.

The Options were granted on January 29, 2026 and each Option is exercisable for a period of five years to acquire one common share of the Company at an exercise price of $4.10 per share.

- January 28, 2026

Goldsky to Become 100% Owner of Barsele Gold Project via Acquisition of Agnico Eagle’s 55% Interest

VANCOUVER, January 28, 2026 – GOLDSKY RESOURCES CORP. (TSXV: GSKR | FNSE: GSKRSDB | OTCQX: GSKRF) (“Goldsky” or the “Company”) is pleased to announce that it has entered into a definitive agreement dated January 28, 2026 (the “Agreement”) with Agnico Eagle Sweden AB (“Agnico Sweden”),

- December 31, 2025

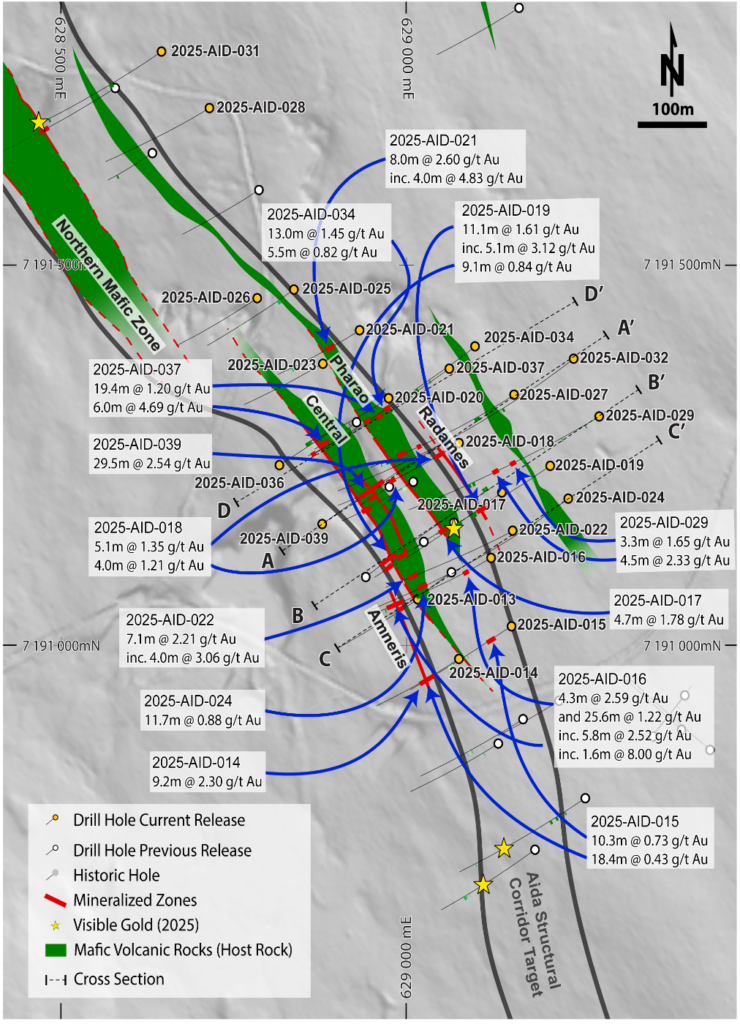

Goldsky Resources final drilling results for Aida 2025 campaign

VANCOUVER, Canada, December 31, 2025 — Goldsky Resources Corp (TSX-V: GSKR, FNSE: GSKR SDB, OTCQX: FNMCD, FRA: HEG0) (“Goldsky Resources ” or the “Company”)is pleased to announce additional results from its 2025 diamond drill program at the Aida target (“Aida”), located within the Company’s 100%-owned Paubäcken project (“Paubäcken” or the “Project”), in Västerbotten County, northern Sweden.

Key Highlights:

Multiple strong gold intercepts continue the expansion story at Aida including: 2.30 g/t Au over 9.2 m (2025-AID-014),- December 22, 2025

Launch of Goldsky Resources

VANCOUVER, Canada, December 22, 2025 — First Nordic Metals Corp. (TSX-V: FNM, FNSE: FNMC SDB, OTCQX: FNMCD, FRA: HEG0) (“First Nordic” or the “Company”) is pleased to announce that, effective as of today’s date, it has changed its name (the “Name Change”) to Goldsky Resources Corp. (“Goldsky”).

The Company’s common shares (the “Common Shares”) are expected to begin trading under the new name and under the ticker ‘GSKR’ on the TSX Venture Exchange (the “TSXV”) on December 24,

- December 16, 2025

First Nordic and Mawson Complete Merger to Create a Leading Nordic-Focused Gold Development and Exploration Company – Mawson Finland Ltd.

Group to rebrand as Goldsky Resources Corp. reflecting new management and board following completion of merger and C$80 million equity raise

TORONTO, Canada, December 16, 2025 — First Nordic Metals Corp. (TSX-V: FNM, FNSE: FNMC SDB, OTCQX: FNMCF, FRA: HEG0) (“First Nordic” or the “Company”) and Mawson Finland Limited(“Mawson”) (TSX-V: MFL, FRA: PM6) are pleased to announce the successful closing of the previously announced acquisition by First Nordic of all of the issued and outstanding common shares of Mawson (the “Mawson

- December 8, 2025

Mawson Receives Final Order for Arrangement with First Nordic Metals – Mawson Finland Ltd.

VANCOUVER, Canada, December 8, 2025 – Mawson Finland Limited (“Mawson” or the “Company”) (TSX-V: MFL) is pleased to announce that the Ontario Superior Court of Justice (Commercial List) has granted the final order (the “Final Order“) in connection with the proposed business combination of Mawson and First Nordic Metals Corp. (TSX-V: FNM, FNSE: FNMC SDB, OTCQX: FNMCF, FRA: HEG0) (“First Nordic”),